is there a death tax in texas

Call or Text 817 841-9906. Sometimes the assets are subject to probate.

Until the most recent legislative session the state had.

. Call our estate planning attorneys to learn more. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. There is a 40 percent federal.

If your gross estate is over 114 million you pay a. Right now there are 6 states that have an inheritance tax. However there is no such tax in Texas and beneficiaries can receive their inheritance without paying any taxes.

Illegal drugs in Texas are no longer taxable. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. Depending on the familial configuration at the time of the deceaseds death it implies that the next of kin ie spouse children parents and siblings are all eligible for a certain percentage of the deceaseds estate.

Explained below is some helpful information on the most important Texas inheritance laws. If you die with a gross estate under 114 million in 2019 no estate tax is due. The state of Texas does not have any inheritance of estate taxes.

In Iowa Kentucky Maryland and New Jersey assets passing to the deceased persons descendants are also exempt. If the estate is large enough then it may have to pay estate tax. For amounts over 1 million those funds will be taxed at a rate of 40.

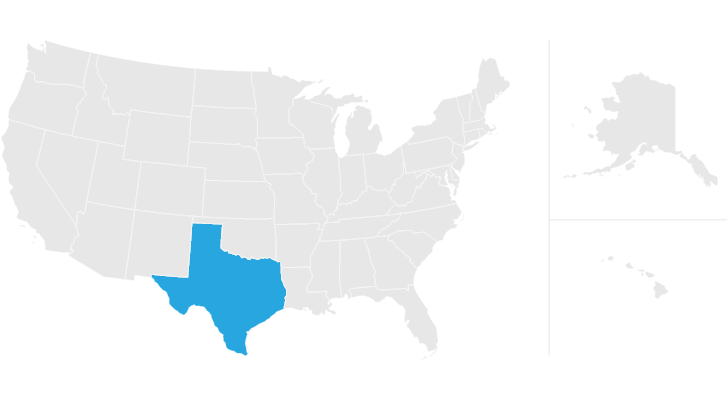

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. In all six states assets passing to the deceased persons surviving spouse and to charity are exempt from the state inheritance tax. Estates worth less than this amount are not subject to the tax.

You can give a gift of up to 15000 to a person without having to pay a federal gift tax. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. On the one hand Texas does not have an inheritance tax.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical. Already the District of Columbia has toughened its estate tax levy effective January 1 2021.

For deaths occurring after September 30 2002 and before January 1 2008 tax was frozen at federal state death tax credit in effect on December 31 2000 and was imposed on estates exceeding federal applicable exclusion amount in effect on December 31 2000 675000 not including scheduled increases under pre-EGTRRA law even though that amount is below the. Tax is tied to federal state death tax credit. Estate taxes and inheritance taxes.

This can add up quickly so it is imperative that you account for these taxes during your estate planning process. As of 2022 the tax is imposed on estates valued at more than 1206 million for an individual or 2412 million for a couple. However in Texas there is no such thing as an inheritance tax or a gift tax.

In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from. The purpose of inheritance tax is to collect revenue from estates to fund state programs and services. In Texas the assets that are left behind after a person dies become part of the deceaseds estate which is distributed to heirs and others through a variety of processes.

The Texas Intestate Succession Laws uses a statutory formula to determine how an estate will be distributed. There is no requirement for you to pay gift taxes for a gift that you give your spouse and also for gifts that you give charities or political organizations. Although theres no estate tax in Texas you still might have to pay federal estate taxes.

But there is a federal gift tax that people in Texas have to pay. On the low end of the scale the rates are 18 for taxable amounts less than 10000. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

That said exactly what you think it said. Someone will likely have to file some taxes on your behalf after your death though including the following. Here are all the most relevant results for your search about Death Tax In Texas.

Final federal and state income tax returns. You will no doubt be glad to learn that the State of Texas has some tax-friendly laws. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance. Taxes imposed by the federal andor state government on someones estate upon their death. In some cases heirs may have to pay tax as well depending.

Thus the likelihood of an inheritance being subject to a state inheritance tax is minimal. The amount of tax depends on the value of your gross estate. It is one of 38 states with no estate tax.

Inheritance and Estate Taxes. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process.

Book a Consultation 512 410-0343. When TRS receives all properly completed documents the. In the US there are actually two different kinds of death taxes.

The federal government imposes a tax on the transfer of your property at death. It is a transfer tax imposed on the wealthy at death. Only 12 states plus the District of Columbia impose an estate tax.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Texas Inheritance Laws What You Should Know Smartasset

Britain S Biggest Uk Solar Farm Unveiled Huge 224 Acre Site Comprising 135 000 Panels Could Be Built On Cornish Farmland Solar Farm Renewable Energy Wind Wind Farm

Texas Inheritance Laws What You Should Know Smartasset

If You See A Little Piketty In This Tax Haven Book That S Fine Tax Haven Book Summaries Wealth

What Is The Probate Process In Texas A Step By Step Guide

:watermark(cdn.texastribune.org/media/watermarks/2012.png,-0,30,0)/static.texastribune.org/media/images/UT-TT-Poll-Thurs-LifeDeath-.128.png)

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

Texas Estate Tax Everything You Need To Know Smartasset

Como Puedo Probar La Herencia En Texas Tax Protest Protest Property Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs

Texas Tod Deed Form Create A Transfer On Death Deed Online

States With No Estate Tax Or Inheritance Tax Plan Where You Die